银行股轮动排名

展开

怎样做出一个银行的轮动排名呢,很多问题要解决,感谢每位吧友的指点。

比如,中国银行,

年报上就有净资产收益率,但是每季的怎么算出来的,

比如,中国银行,

| 科目年度 | 2017/3/31 | 2016/12/31 | 2016/9/30 | 2016/6/30 | 2016/3/31 | 2015/12/31 |

| 基本每股收益(元) | 0.15 | 0.1 | 0.14 | 0.16 | 0.15 | 0.13 |

| 净利润(元) | 466.49亿 | 297.65亿 | 417.76亿 | 464.18亿 | 466.19亿 | 393.00亿 |

| 净利润同比增长率 | 0.06% | -24.26% | 2.39% | 3.36% | 1.70% | 2.18% |

| 扣非净利润(元) | 450.64亿 | 285.34亿 | 412.42亿 | 277.18亿 | 463.47亿 | 386.54亿 |

| 扣非净利润同比增长率 | -2.77% | -26.18% | 0.93% | -37.68% | 1.52% | 1.52% |

| 营业总收入(元) | 1292.95亿 | 1145.60亿 | 1071.75亿 | 1390.76亿 | 1228.19亿 | 1175.48亿 |

| 营业总收入同比增长率 | 5.27% | -2.54% | -8.56% | 17.74% | 1.14% | 6.86% |

| 每股净资产(元) | 4.59 | 4.46 | 4.38 | 4.24 | 4.24 | 4.09 |

| 净资产收益率 | 3.44% | 2.34% | 2.85% | 3.70% | 3.69% | 3.26% |

| 净资产收益率-摊薄 | 3.21% | 1.96% | 2.80% | 3.44% | 3.46% | 2.64% |

| 资产负债比率 | 91.92% | 92.38% | 82.59% | 96.91% | 91.77% | 66.19% |

| 每股资本公积金(元) | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 | 0.48 |

| 每股未分配利润(元) | 2.06 | 1.9 | 1.9 | 1.78 | 1.79 | 1.64 |

| 每股经营现金流(元) | 1.31 | 0.8 | -0.3 | 0.63 | -0.51 | 0.46 |

| 销售净利率 | 38.92% | 38.06% | 41.06% | 40.97% | 39.60% | 37.83% |

年报上就有净资产收益率,但是每季的怎么算出来的,

| 代码 | 名称 | 现价 | 每股收益 | 每股帐面净值 | 市盈率 | 市净率 | 资产收益率 | 资产翻倍期2 |

| SH601988 | 中国银行 | 3.76 | 0.55 | 4.59 | 6.84 | 0.82 | 12.33% | 4.246003225 |

话题与分类:

主题股票:

主题概念:

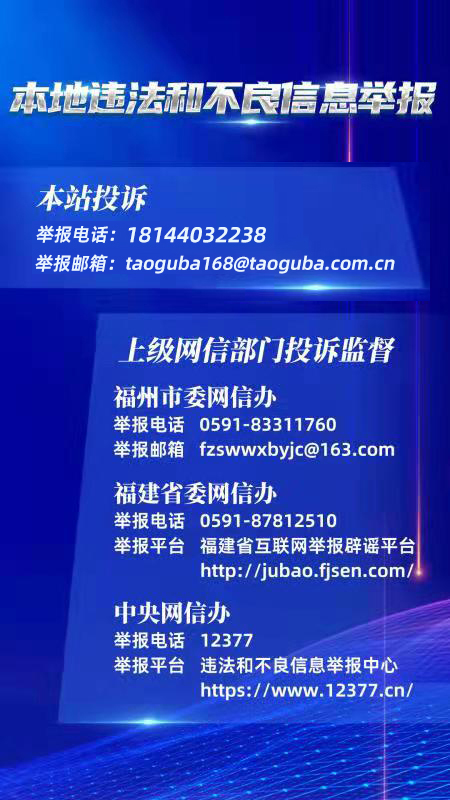

声明:遵守相关法律法规,所发内容承担法律责任,倡导理性交流,远离非法证券活动,共建和谐交流环境!